By Karen Henriques March 5, 2025

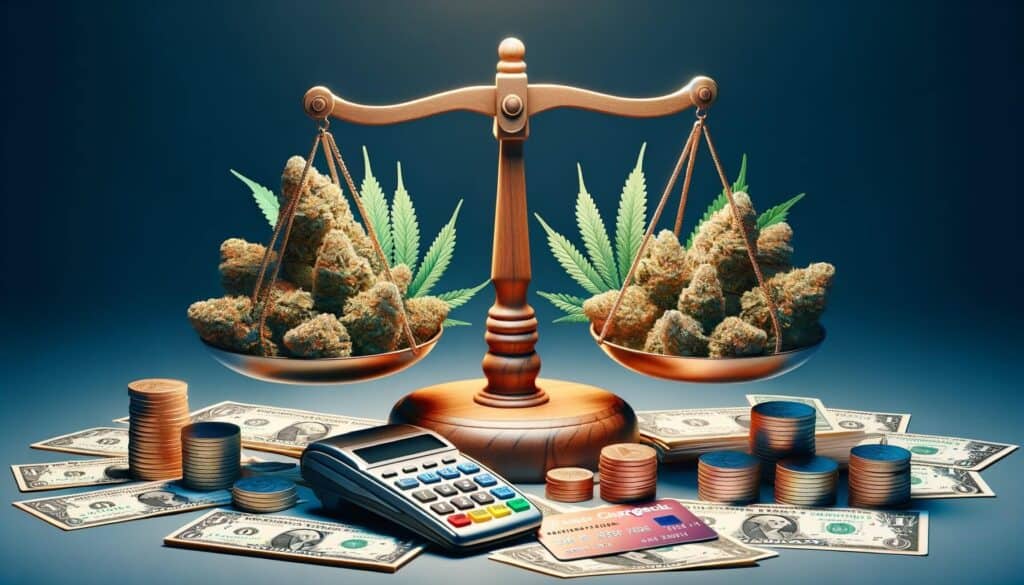

The cannabis industry has experienced significant growth in recent years, with the legalization of medical and recreational marijuana in several states and countries. However, despite this growth, the cannabis sector remains classified as high-risk due to various factors, including legal and regulatory uncertainties, limited access to banking services, and the stigma associated with the industry.

One of the major challenges faced by cannabis businesses is the risk of chargebacks, which can have a significant impact on their operations and profitability. In this article, we will explore the concept of chargebacks, their implications for the cannabis sector, and strategies to mitigate these risks.

Understanding the High-Risk Nature of the Cannabis Industry

The cannabis industry is considered high-risk due to several factors. Firstly, the legal and regulatory landscape surrounding cannabis is complex and constantly evolving. While some states and countries have legalized the use of marijuana for medical or recreational purposes, it remains illegal at the federal level in many jurisdictions. This legal ambiguity creates challenges for cannabis businesses, including limited access to banking services, higher compliance costs, and difficulties in obtaining insurance coverage.

Secondly, the stigma associated with the cannabis industry contributes to its high-risk classification. Despite the growing acceptance of marijuana for medical and recreational use, there are still negative perceptions and stereotypes associated with cannabis. This stigma can impact the reputation of cannabis businesses and make it more difficult for them to establish relationships with financial institutions, suppliers, and customers.

Lastly, the nature of the cannabis industry itself presents inherent risks. The cultivation, production, and distribution of cannabis involve various compliance requirements, such as licensing, quality control, and inventory management. Failure to comply with these regulations can result in legal consequences, financial penalties, and reputational damage.

What is a Chargeback and How Does it Affect the Cannabis Sector?

A chargeback occurs when a customer disputes a transaction and requests a refund from their credit card issuer. This can happen for various reasons, including unauthorized transactions, product dissatisfaction, or fraudulent activity. When a chargeback is initiated, the funds are taken from the merchant’s account and returned to the customer, along with any associated fees.

In the cannabis sector, chargebacks can have a significant impact on businesses. Due to the high-risk nature of the industry, many cannabis businesses have limited access to traditional banking services. As a result, they often rely on alternative payment methods, such as credit card processing companies that specialize in high-risk industries. These payment processors charge higher fees and impose stricter terms and conditions to mitigate the risks associated with the cannabis sector.

When chargebacks occur, cannabis businesses not only lose the revenue from the disputed transaction but also incur additional fees and penalties imposed by the payment processor. Moreover, excessive chargebacks can lead to the termination of the merchant account, making it even more challenging for cannabis businesses to process payments and operate effectively.

Common Reasons for Chargebacks in the Cannabis Industry

Several factors contribute to the occurrence of chargebacks in the cannabis industry. Understanding these common reasons can help businesses identify potential risks and implement strategies to mitigate them.

1. Unauthorized Transactions: One of the primary reasons for chargebacks in the cannabis sector is unauthorized transactions. This can occur when a customer’s credit card is used without their consent, either due to stolen card information or fraudulent activity. In such cases, the customer may dispute the transaction and request a chargeback.

2. Product Dissatisfaction: Another common reason for chargebacks is product dissatisfaction. Customers may dispute a transaction if they are not satisfied with the quality, potency, or effectiveness of the cannabis product they purchased. This can be subjective and challenging to resolve, as individual preferences and expectations vary.

3. Delivery Issues: Chargebacks can also occur due to delivery issues. Cannabis businesses that offer online or delivery services may face challenges in ensuring timely and accurate deliveries. If a customer does not receive their order or experiences delays, they may initiate a chargeback.

4. Compliance and Regulatory Concerns: The complex regulatory landscape surrounding the cannabis industry can also contribute to chargebacks. If a cannabis business fails to comply with licensing requirements, age verification protocols, or other regulatory obligations, customers may dispute the transaction and request a chargeback.

5. Fraudulent Activity: The high-risk nature of the cannabis industry makes it an attractive target for fraudulent activity. Fraudsters may use stolen credit card information to make unauthorized purchases from cannabis businesses. When the legitimate cardholder discovers the fraudulent transaction, they may initiate a chargeback.

Assessing the Impact of Chargebacks on Cannabis Businesses

Chargebacks can have a significant impact on cannabis businesses, both financially and operationally. Firstly, the loss of revenue from chargebacks can directly affect the profitability of the business. In addition to refunding the disputed amount, businesses may also incur chargeback fees imposed by payment processors. These fees can range from $20 to $100 per chargeback, depending on the terms and conditions of the payment processor.

Furthermore, excessive chargebacks can result in the termination of the merchant account. Payment processors closely monitor chargeback ratios, which measure the number of chargebacks in relation to the total number of transactions. If a cannabis business exceeds the acceptable chargeback ratio, the payment processor may terminate the merchant account, making it difficult for the business to process payments and continue operations.

Moreover, chargebacks can damage the reputation of cannabis businesses. Negative reviews and complaints from dissatisfied customers can impact the credibility and trustworthiness of the business. This can deter potential customers and make it more challenging to attract and retain a loyal customer base.

Strategies to Mitigate Chargeback Risks in the Cannabis Sector

While chargebacks are an inherent risk in the cannabis sector, businesses can implement strategies to mitigate these risks and minimize their impact. Here are some effective strategies to consider:

1. Clear and Transparent Communication: Providing clear and transparent information about products, pricing, and delivery terms can help manage customer expectations and reduce the likelihood of chargebacks. Clearly communicate any limitations or restrictions associated with the purchase and delivery of cannabis products.

2. Robust Age Verification Processes: Implementing robust age verification processes is crucial in the cannabis industry, where the sale of products is restricted to individuals of legal age. Utilize reliable age verification technologies and require customers to provide valid identification before completing a purchase.

3. Quality Control and Product Testing: Ensuring the quality and potency of cannabis products is essential to minimize product dissatisfaction and chargebacks. Implement rigorous quality control measures and conduct regular product testing to maintain consistency and meet customer expectations.

4. Secure Payment Processing: Partner with reputable payment processors that specialize in high-risk industries, such as the cannabis sector. These processors often have advanced fraud detection and prevention systems in place, reducing the risk of fraudulent transactions and chargebacks.

5. Customer Support and Dispute Resolution: Establish a dedicated customer support team to address customer inquiries, concerns, and disputes promptly. Providing excellent customer service and resolving issues in a timely manner can help prevent chargebacks and maintain customer satisfaction.

Implementing Effective Fraud Prevention Measures in the Cannabis Industry

Fraud prevention is crucial in the cannabis industry, given its high-risk nature. Implementing effective fraud prevention measures can help mitigate chargeback risks and protect the business from fraudulent activity. Here are some key strategies to consider:

1. Fraud Detection Systems: Utilize advanced fraud detection systems that analyze transaction data and identify suspicious patterns or behaviors. These systems can help flag potentially fraudulent transactions and reduce the risk of chargebacks.

2. Two-Factor Authentication: Implement two-factor authentication for online transactions to enhance security and prevent unauthorized access. Require customers to provide additional verification, such as a unique code sent to their mobile device, before completing a purchase.

3. IP Geolocation and Proxy Detection: Use IP geolocation and proxy detection technologies to identify the location and origin of online transactions. This can help detect and prevent fraudulent activity, such as the use of stolen credit card information from different geographic locations.

4. Transaction Velocity Monitoring: Monitor transaction velocity, which measures the frequency and volume of transactions within a specific time period. Unusually high transaction velocity can indicate fraudulent activity, such as the use of automated bots or stolen credit card information.

5. Employee Training and Awareness: Educate employees about fraud prevention best practices and raise awareness about the risks associated with the cannabis industry. Train employees to identify and report suspicious transactions or behaviors to prevent fraudulent activity.

Best Practices for Handling Chargebacks in the High-Risk Cannabis Sector

Despite implementing preventive measures, chargebacks may still occur in the cannabis sector. Handling chargebacks effectively is crucial to minimize their impact on the business. Here are some best practices for managing chargebacks:

1. Maintain Detailed Transaction Records: Keep detailed records of all transactions, including customer information, purchase details, and delivery confirmation. These records can be valuable evidence in case of chargeback disputes.

2. Respond Promptly to Chargeback Notifications: When notified of a chargeback, respond promptly to provide all relevant information and evidence to support your case. Failure to respond within the specified timeframe can result in an automatic chargeback reversal in favor of the customer.

3. Dispute Chargebacks When Appropriate: If you believe a chargeback is unjustified or fraudulent, dispute it with the credit card issuer. Provide all necessary documentation and evidence to support your case, such as proof of delivery or customer communication.

4. Monitor and Analyze Chargeback Data: Regularly monitor and analyze chargeback data to identify trends, patterns, and potential areas for improvement. This can help identify recurring issues and implement strategies to prevent future chargebacks.

5. Continuously Improve Fraud Prevention Measures: Fraud prevention is an ongoing process. Regularly review and update your fraud prevention measures to stay ahead of evolving fraud tactics and protect your business from chargebacks.

Frequently Asked Questions (FAQs) about Chargebacks in the Cannabis Industry

Q1. What is the chargeback ratio, and why is it important for cannabis businesses?

Answer: The chargeback ratio measures the number of chargebacks in relation to the total number of transactions. Payment processors closely monitor this ratio to assess the risk associated with a merchant account. Excessive chargebacks can result in the termination of the merchant account, making it difficult for cannabis businesses to process payments.

Q2. Can cannabis businesses appeal a terminated merchant account?

Answer: In some cases, cannabis businesses may be able to appeal a terminated merchant account. However, the success of the appeal depends on various factors, including the reason for termination, the payment processor’s policies, and the business’s ability to demonstrate improved risk management and fraud prevention measures.

Q3. How can cannabis businesses reduce the risk of unauthorized transactions?

Answer: To reduce the risk of unauthorized transactions, cannabis businesses should implement robust security measures, such as two-factor authentication and secure payment processing. Additionally, regularly monitoring transaction data and analyzing patterns can help identify and prevent fraudulent activity.

Q4. What should cannabis businesses do if they receive a chargeback for product dissatisfaction?

Answer: When a customer disputes a transaction due to product dissatisfaction, cannabis businesses should promptly address the issue and offer a resolution. This may involve providing a refund, offering a replacement product, or engaging in open communication to understand and resolve the customer’s concerns.

Q5. How can cannabis businesses improve their reputation and customer trust?

Answer: Cannabis businesses can improve their reputation and customer trust by providing high-quality products, excellent customer service, and transparent communication. Implementing effective fraud prevention measures and promptly addressing customer concerns can also contribute to building trust and credibility.

Conclusion

Chargeback risks pose significant challenges to the high-risk cannabis sector. Understanding the nature of these risks and implementing effective strategies to mitigate them is crucial for the success and sustainability of cannabis businesses.

By maintaining clear communication, implementing robust fraud prevention measures, and handling chargebacks effectively, cannabis businesses can minimize the financial and operational impact of chargebacks and build a strong foundation for growth in this evolving industry.